I'm on the road this week, so I just finally got a chance to read through some of the financial carnivals that went up today.

Carnival of Debt Reduction

The Carnival of Debt Reduction #7 is up at Blueprint for Financial Prosperity (thanks Jim!) and includes posts on expense and debt reduction techniques, losing faith...and finding inspiration...and more.

Jane Dough is a gal after my own heart: slashing those bills and cooking with gas are both cost reduction methods I have been using a lot over the past few months. I lowered my telecomm, long distance, auto insurance and Netflix recently and I've been cooking more to clear the pantry clutter.

No Credit Needed is bumming about missing the details of when his juicy zero percent promo rate expires (always read the fine print folks!). Meanwhile, Frugal for Life reminds us that there will be pitfalls along the way but the important thing is the journey toward change. Persevering through the disappointing moments brings the most satisfaction when you succeed. NCN should take heart :) success is just up ahead!

Carnival of Personal Finance

The Carnival of Personal Finance hits the big 2-0 this week and is being hosted by Wealthy Web. It's so large I've barely started but a few things grabbed my attention.

I'll be checking out BudgetBitch because the name alone had me laughing and I haven't seen that blog before. And she has a little dog. What's not to like?

And I will definitely be keeping up with the Dividend Guy's guide to building a dividend portfolio since this is something I have recently become interested in. I'm looking forward to learning how he approaches the whole process.

And JLP has a very timely post about itemized deductions and planning for this years taxes now before it is too late...I just started doing napkin math this week to estimate if I will owe taxes this year and his post will help me do that.

Now I have to go finish reading....

Monday, October 31, 2005

Sunday, October 30, 2005

Pantry Challenge Extension

Tip o' the blog to Graham who stopped by and asked for an update on my pantry challenge.

We're having some success with the October Pantry Challenge but I think we'll need to re-christen it the Q4 Pantry Challenge. We haven't been as aggressive with finding new recipes designed to plow through our dry good backlog as I'd liked. Our food spending has been down a bit, but long work hours this month have meant I'm not terribly enthusiastic about cooking every night. So its been a mixed bag.

We've finished off some boxes of pasta but partial boxes of both spaghetti and angel hair remain. Our two boxes of Pomi tomato products (crushed and chopped) made THE best chili ever (citric acid blows). We've used all of our turkey and chicken stock that was crowding the freezer. We've also made inroads into some ingredients like rice and lentils but they aren't gone yet.

And Graham may have lots of tuna...but I have 3 cans of crabmeat that I don't even know how to use.

I think one of the keys to making this a success is to get all of the targeted food into the backpack list. Then I can search for recipes and LaLa and I can later collaborate on cooking. I've only added items as I remember that we have them and I need to be more focused about that.

I'm traveling for business this week, so there are some LaLa only items she intends to purge from the pantry, and for the rest of November and December we're traveling quite a bit so we might need until the end of the year to get it "done". Then I guess we just make sure we have the right staples for 2006!

We're having some success with the October Pantry Challenge but I think we'll need to re-christen it the Q4 Pantry Challenge. We haven't been as aggressive with finding new recipes designed to plow through our dry good backlog as I'd liked. Our food spending has been down a bit, but long work hours this month have meant I'm not terribly enthusiastic about cooking every night. So its been a mixed bag.

We've finished off some boxes of pasta but partial boxes of both spaghetti and angel hair remain. Our two boxes of Pomi tomato products (crushed and chopped) made THE best chili ever (citric acid blows). We've used all of our turkey and chicken stock that was crowding the freezer. We've also made inroads into some ingredients like rice and lentils but they aren't gone yet.

And Graham may have lots of tuna...but I have 3 cans of crabmeat that I don't even know how to use.

I think one of the keys to making this a success is to get all of the targeted food into the backpack list. Then I can search for recipes and LaLa and I can later collaborate on cooking. I've only added items as I remember that we have them and I need to be more focused about that.

I'm traveling for business this week, so there are some LaLa only items she intends to purge from the pantry, and for the rest of November and December we're traveling quite a bit so we might need until the end of the year to get it "done". Then I guess we just make sure we have the right staples for 2006!

November Challenge...It's So AWN!

The travel gnome and I decided we'd engage in a friendly competition to see who can rack up the most in "online sales" during the month of November. I needed a nudge in the butt to start clearing clutter and generating some extra holiday cash and this is just the ticket.

I think we agreed that ebay, amazon marketplace and craigslist all count and the sale has to complete within the month of November, but money received in December for a November transaction still counts.

He always wins...even if we're racing through parallel lunch lines...but I figure this is a win/win for me whatever the outcome. I haven't entered the competition with the gusto I had intended, but I did get some graphic novels up on Amazon for sale. Anything I can sell this month is a nice extra.

You can see links to my Amazon items for sale in the right column around the site (currently on archive pages only) which are generated by a nice little service called amazonbox. I can't place javascript inside a blogger post (or I don't know how anyway) so if you're interested in what it looks like you'll have to look at something like the October archive.

I think we agreed that ebay, amazon marketplace and craigslist all count and the sale has to complete within the month of November, but money received in December for a November transaction still counts.

He always wins...even if we're racing through parallel lunch lines...but I figure this is a win/win for me whatever the outcome. I haven't entered the competition with the gusto I had intended, but I did get some graphic novels up on Amazon for sale. Anything I can sell this month is a nice extra.

You can see links to my Amazon items for sale in the right column around the site (currently on archive pages only) which are generated by a nice little service called amazonbox. I can't place javascript inside a blogger post (or I don't know how anyway) so if you're interested in what it looks like you'll have to look at something like the October archive.

Labels:

amazon,

income,

recommerce

Managing Credit Card Spending

When I first signed up for the Citi Platinum Dividend Card, I had intended to pay off the balance twice a month. I have actually only been paying it off once a month but I use Quicken to help keep me on top of what I've spent so I can always pay off the balance in full after my second paycheck of the month.

Every month after paying off the last Citi balance, I create a new Quicken transaction and date it a day or so after my 2nd paycheck will be deposited (this is well before my payment due date). I set this up as a transfer between my checking account and my Citi account.

In the check number field (also used for DEP, ATM, and EFT) I place the word HOLD which is my own designation for something that will happen in the future, but still needs action (like to enter an actual payment online for example). I think of these transactions as money "set aside" for the future, but by entering them in this way they are highly visible in Quicken and I see the immediate impace to my balances.

Then I constantly update that balance to always match what has been charged to the Citi card up until the day I pay the statement balance (on or just after paycheck #2). I use the "update" feature in Quicken to download all credit card transactions often. When I am home during the week, I even do this daily...but I do it at least once a week. Once the credit card transactions are downloaded, I note the total due on the card, and update the HOLD transaction to match making the result of that future payment a zero balance.

The net effect of this is that every time we use the card, the impact is noted in our checking account almost immediately. This allows me to always stay on top of the balance and I have been able to pay my credit card balances in full since earlier this year.

Other quicken tips: How to add I-Bonds to Quicken and using a personal receivables account to track future incoming money.

Every month after paying off the last Citi balance, I create a new Quicken transaction and date it a day or so after my 2nd paycheck will be deposited (this is well before my payment due date). I set this up as a transfer between my checking account and my Citi account.

In the check number field (also used for DEP, ATM, and EFT) I place the word HOLD which is my own designation for something that will happen in the future, but still needs action (like to enter an actual payment online for example). I think of these transactions as money "set aside" for the future, but by entering them in this way they are highly visible in Quicken and I see the immediate impace to my balances.

Then I constantly update that balance to always match what has been charged to the Citi card up until the day I pay the statement balance (on or just after paycheck #2). I use the "update" feature in Quicken to download all credit card transactions often. When I am home during the week, I even do this daily...but I do it at least once a week. Once the credit card transactions are downloaded, I note the total due on the card, and update the HOLD transaction to match making the result of that future payment a zero balance.

The net effect of this is that every time we use the card, the impact is noted in our checking account almost immediately. This allows me to always stay on top of the balance and I have been able to pay my credit card balances in full since earlier this year.

Other quicken tips: How to add I-Bonds to Quicken and using a personal receivables account to track future incoming money.

Saturday, October 29, 2005

60% Solution Budget Revisited

When I was getting started this year, I was drawn to the simplicity of the 60% Solution budget which is built around the following ratios: 30% toward savings, 60% toward committed expenses, 10% for fun. This is very similar to the method described in the book All Your Worth of 20% savings, 50% committed, 30% wants.

These are really just two "two-line" budgets when you boil it down...you are deciding to "pay yourself first" either 30% or 20% depending on which budgeting method you are trying out (and I am sure there are many other permutations) and the rest has to cover all your expenses committed or fluff. Easy peasy....in theory.

This year I've been aiming for the 60% solution which is really all about saving 30% of my income. Between maxing out my 401k (15%) and catching up on maxing out my 2005 Roth (7%) - both long term savings - I need to find $637 for short term savings in order to be saving 30% total. That's felt like a stretch, but by some quirk of fate and math that is exactly what I put into savings last month.

I've been trimming bills here and there to try to get closer to that $637 every month and I feel thwarted by increases beyond my control (health insurance, natural gas) but it's a clear target. And I am finally getting the hang of paying myself first.

These are really just two "two-line" budgets when you boil it down...you are deciding to "pay yourself first" either 30% or 20% depending on which budgeting method you are trying out (and I am sure there are many other permutations) and the rest has to cover all your expenses committed or fluff. Easy peasy....in theory.

This year I've been aiming for the 60% solution which is really all about saving 30% of my income. Between maxing out my 401k (15%) and catching up on maxing out my 2005 Roth (7%) - both long term savings - I need to find $637 for short term savings in order to be saving 30% total. That's felt like a stretch, but by some quirk of fate and math that is exactly what I put into savings last month.

I've been trimming bills here and there to try to get closer to that $637 every month and I feel thwarted by increases beyond my control (health insurance, natural gas) but it's a clear target. And I am finally getting the hang of paying myself first.

Savings to Emigrant Direct

I've been doing financial housekeeping today...moving money around...fiddling in Quicken and such.

I've got my ING to Emigrant Direct transfer set up for Monday. So by Monday all of the money in the Save-O-Meter will be in Emigrant with the exception of 2 $100 I-bonds, one purchased this month and the other set for later in November.

In Quicken, I've moved my Emigrant Direct account to the Investing section since it's for accumulating a cash emergency fund and not for cash flow. I've left the ING in the cash flow section because I intend to use that "freedom-account-style" for very short duration savings and enacting my spending plan.

My HSBC Online Savings Account is all set up for online access (thank god they are re-designing their website). I can now access my mortgage through their site, but only to get quick facts like interest paid this year, escrow info, loan details and such. I did notice they appear to allow transfers from my new online savings account into the loan account, so that may hold promise for me being able to flexibly pay down my mortgage at no extra cost to me. We'll see. At least opening the account netted me another $35.

I've got my ING to Emigrant Direct transfer set up for Monday. So by Monday all of the money in the Save-O-Meter will be in Emigrant with the exception of 2 $100 I-bonds, one purchased this month and the other set for later in November.

In Quicken, I've moved my Emigrant Direct account to the Investing section since it's for accumulating a cash emergency fund and not for cash flow. I've left the ING in the cash flow section because I intend to use that "freedom-account-style" for very short duration savings and enacting my spending plan.

My HSBC Online Savings Account is all set up for online access (thank god they are re-designing their website). I can now access my mortgage through their site, but only to get quick facts like interest paid this year, escrow info, loan details and such. I did notice they appear to allow transfers from my new online savings account into the loan account, so that may hold promise for me being able to flexibly pay down my mortgage at no extra cost to me. We'll see. At least opening the account netted me another $35.

Quiet This Week...I Caved on Heat

This week I was stunned and saddened by the loss of Tom Masland, a very close personal friend of my family's, and all-around really good egg. Newsweek has links to some of his work...it's all good stuff even if it's not related to personal finance. This is just my little shout-out to a wonderful man who will be missed by all who knew him.

I just haven't felt like writing much.

So, I finally turned on our upstairs heat this afternoon. Temperatures were solidly below 60 in our house this morning and in fact our downstairs is currently 54 degrees.

And it's snowing.

I just couldn't bear the loss, the clouds *and* the cold.

I just haven't felt like writing much.

So, I finally turned on our upstairs heat this afternoon. Temperatures were solidly below 60 in our house this morning and in fact our downstairs is currently 54 degrees.

And it's snowing.

I just couldn't bear the loss, the clouds *and* the cold.

Tuesday, October 25, 2005

First Citi Dividend Received

I wish I had waited until my statement closing date to request my check, but the lure of the > $50 total was too much to bear. I thought there would not be much of a difference between when I my cycle date and when requested the check a few days before. But there was like a $17 bump on my cycle date (must have been those gas and grocery bonus points), so if I had waited I could have received over $75.

Note to self, next time WAIT until the cycle date.

The check only took about 6 business days to arrive, and my $59.13 is the result of about 10 weeks of spending (including the washing machine).

Aside from their online "security" annoyances, I'm pretty happy with a credit card that sends me cash.

Note to self, next time WAIT until the cycle date.

The check only took about 6 business days to arrive, and my $59.13 is the result of about 10 weeks of spending (including the washing machine).

Aside from their online "security" annoyances, I'm pretty happy with a credit card that sends me cash.

Monday, October 24, 2005

Carnival of Personal Finance 19

The new carnival is up at Consumerism Commentary. As usual there are a diverse set of links to peruse.

I truly love the entry from Personal Finance Advice where Jeremy writes about the process of taking a $45 errand and trimming more than $30 off the cost. It's so simple and everyone can take inspiration from it and look for small ways to shave spending. It will add up!

Frank at Hello, Dollar! is also in the process of organizing his long term goals so I will definitely be keeping tabs on how he goes through that process. Mine are still fuzzy I think...but getting clearer. It's interesting to see how others approach the forming of goals.

And I picked up some pantry stocking tips at the Chief Family Officer - once I reduce the amount of strange items in my pantry I can stock it with useful things we'll use all the time. Put shredded cheese in the freezer! Who knew? Oh, and apparently I should be keeping soy sauce in the fridge? Oops.

Of course there were many more posts of note ... juicy as ever!

I truly love the entry from Personal Finance Advice where Jeremy writes about the process of taking a $45 errand and trimming more than $30 off the cost. It's so simple and everyone can take inspiration from it and look for small ways to shave spending. It will add up!

Frank at Hello, Dollar! is also in the process of organizing his long term goals so I will definitely be keeping tabs on how he goes through that process. Mine are still fuzzy I think...but getting clearer. It's interesting to see how others approach the forming of goals.

And I picked up some pantry stocking tips at the Chief Family Officer - once I reduce the amount of strange items in my pantry I can stock it with useful things we'll use all the time. Put shredded cheese in the freezer! Who knew? Oh, and apparently I should be keeping soy sauce in the fridge? Oops.

Of course there were many more posts of note ... juicy as ever!

Sunday, October 23, 2005

Adding I-Bonds to Quicken

I am sort of a n00b when it comes to tracking anything other than deposits, withdrawals and mutual funds in Quicken so I was quite vexed about how to track the I-Bond I will effectively purchase on Monday.

My google-fu was hurting on this one and didn't really turn up much. I originally had trouble finding what I wanted in Quicken Help ... primarily because a wrong turn quickly led me to their horrific support site which turned up nothing relevant.

After I stumbled on how to do it myself, I did find their instructions in the application help file, under Contents -> Investing -> Tracking Bonds and CDs -> How do I... -> Buy a Bond (though you will have to add the bond to the security list before executing the "buy a bond" steps if you are adding a US Savings Bond).

The way I did it was essentially the same, but in more of a streamlined manner (well, I thought so anyway):

My google-fu was hurting on this one and didn't really turn up much. I originally had trouble finding what I wanted in Quicken Help ... primarily because a wrong turn quickly led me to their horrific support site which turned up nothing relevant.

After I stumbled on how to do it myself, I did find their instructions in the application help file, under Contents -> Investing -> Tracking Bonds and CDs -> How do I... -> Buy a Bond (though you will have to add the bond to the security list before executing the "buy a bond" steps if you are adding a US Savings Bond).

The way I did it was essentially the same, but in more of a streamlined manner (well, I thought so anyway):

- I added an account, chose "not a financial institution" and called it US Treasury

- Once in the US Treasury account window, I chose "Enter Transactions"

- I used 200510I for the security name

- I used 100 for number of shares (this differs from Quicken instructions)

- I used 1 for cost per share (this differs from Quicken instructions) for a total cost of $100

- Quicken prompted me to add 200510I to the security list, I left ticker symbol blank and clicked next

- On the next screen I chose "add manually" and security type of U.S. Savings Bond

- On the next screen I entered the maturity date (+30 years on the first of the month) and accepted the asset class of "domestic bonds"

No Heat Yet...and Holding

Due to the expected rise in natural gas prices, we are determined to reduce our usage over last year to help defray the cost increase. I'd hate to be shaving my cable bills and Netflix only to have it all eaten up by my gas bill.

We have insulation, double-paned windows, and programmable thermostats so we need to dig down to the next level and find other low or no-cost ways to reduce gas usage. One thing we decided early on was not to turn our heat on until November 1st. This being New England, our downstairs is now 59 degrees (but upstairs is 62 which is somewhat tolerable). LaLa works from home as a freelance web designer, and I work from home most of the time (when I am not onsite at a client) so we look for ways of tolerating the dropping temps.

Hats and Warm Clothing

I kid you not...we wear little knit caps around the house and this is much warmer. We substitute hooded sweatshirts worn hood-up and that actually does double duty of keeping the neck warm. Turtlenecks, sweaters and wool socks are also adding to the retention of body heat.

Tea

We borrowed a civility from the British and have added daily tea time to our routine. The tea helps warm us up and the cookies don't suck.

Blankets

We get great passive solar heating in our office but we've had days of gloomy raw cloudy days that has left us without this benefit. In the evening, we wrap small woolen throws around our shoulders that we picked up for a couple of bucks at the thrift store. If we are watching TV downstairs (aka "The meat locker") we have a bigger warmer blanket that we drape over our legs.

Window Treatment Management

We probably waited a bit too long to pull down the storm windows, but that's finally done. The other small thing we do is open the blinds during the day to capture whatever solar benefit we can, and close them when the light starts fading to help hold in a small amount of heat.

We're just determined to get to November 1 without heating assistance and will likely not be living like this all winter. I am a complete wuss about the cold and LaLa's from California so.... ;)

Before we do turn on the heat, we will re-program our thermostats to be a little lower than last year and do some real thinking about timing and our heating zones to make sure we're only heating what we use automatically and leaving everything else to "on demand".

We have insulation, double-paned windows, and programmable thermostats so we need to dig down to the next level and find other low or no-cost ways to reduce gas usage. One thing we decided early on was not to turn our heat on until November 1st. This being New England, our downstairs is now 59 degrees (but upstairs is 62 which is somewhat tolerable). LaLa works from home as a freelance web designer, and I work from home most of the time (when I am not onsite at a client) so we look for ways of tolerating the dropping temps.

Hats and Warm Clothing

I kid you not...we wear little knit caps around the house and this is much warmer. We substitute hooded sweatshirts worn hood-up and that actually does double duty of keeping the neck warm. Turtlenecks, sweaters and wool socks are also adding to the retention of body heat.

Tea

We borrowed a civility from the British and have added daily tea time to our routine. The tea helps warm us up and the cookies don't suck.

Blankets

We get great passive solar heating in our office but we've had days of gloomy raw cloudy days that has left us without this benefit. In the evening, we wrap small woolen throws around our shoulders that we picked up for a couple of bucks at the thrift store. If we are watching TV downstairs (aka "The meat locker") we have a bigger warmer blanket that we drape over our legs.

Window Treatment Management

We probably waited a bit too long to pull down the storm windows, but that's finally done. The other small thing we do is open the blinds during the day to capture whatever solar benefit we can, and close them when the light starts fading to help hold in a small amount of heat.

We're just determined to get to November 1 without heating assistance and will likely not be living like this all winter. I am a complete wuss about the cold and LaLa's from California so.... ;)

Before we do turn on the heat, we will re-program our thermostats to be a little lower than last year and do some real thinking about timing and our heating zones to make sure we're only heating what we use automatically and leaving everything else to "on demand".

New Blog Description

I've been thinking about my blog's tagline ever since I read through my complimentary issue of Money magazine arrived. The November issue focuses on "The Dream Retirement" and I found some food for thought here and there. But what really jumped out at me is their focus on several "retired" couples...who were *working*....and not just working, but often full time! Of course they were doing what they love...yaddy yaddy, but I thought that was an interesting use of the term "retirement".

I really interpreted these articles as being more about financial independence. I don't really expect to "retire" early...what I truly want is financial independence. The freedom to choose how I trade my time for income that will sustain my chosen quality of life. For me this is a two part puzzle...building wealth as well as reducing my need for income...so I will hopefully meet my goals somewhere in between the two.

So I decided to change the official description of my blog to reflect that realization and to give it an even more positive spin (before I was just "trying", now I'm gonna do it!). Coincidentally, while researching another post tonight, I found pfblog's post where mm did the same thing this year.

So here is the official old and new descriptions (bolded is what has changed)...

Old: "Charting my progress and sharing experiences as I try to go from clutter queen to cash-tastic and enjoy an early retirement"

New: "Charting my progress and sharing experiences as I go from clutter queen to cash-tastic and achieve financial freedom"

I really interpreted these articles as being more about financial independence. I don't really expect to "retire" early...what I truly want is financial independence. The freedom to choose how I trade my time for income that will sustain my chosen quality of life. For me this is a two part puzzle...building wealth as well as reducing my need for income...so I will hopefully meet my goals somewhere in between the two.

So I decided to change the official description of my blog to reflect that realization and to give it an even more positive spin (before I was just "trying", now I'm gonna do it!). Coincidentally, while researching another post tonight, I found pfblog's post where mm did the same thing this year.

So here is the official old and new descriptions (bolded is what has changed)...

Old: "Charting my progress and sharing experiences as I try to go from clutter queen to cash-tastic and enjoy an early retirement"

New: "Charting my progress and sharing experiences as I go from clutter queen to cash-tastic and achieve financial freedom"

Added Receivables Account in Quicken

I thought mm was a little overly meticulous when I first saw his receivables line item in his networth reports. Now I'm totally onboard! I added it to Quicken on Friday to track things like outstanding rebates, insurance claims, cash rewards and earnings that are owed to me, but not yet accessible.

I'm not sure when all of it will trickle in, but I figure I have about $400 of receivables right now and I like being able to see that as a part (albeit pending) of my cash flow. I do not intend to include this when I calculate net worth though.

I'm not sure when all of it will trickle in, but I figure I have about $400 of receivables right now and I like being able to see that as a part (albeit pending) of my cash flow. I do not intend to include this when I calculate net worth though.

Calculating Tax Equivalent Yields

Pepper and I had a good long discussion at the pool hall about various options for a low-risk income producing investment of $20,000 (LaLa and the gear girl were otherwise engaged in a friendly game of darts...they do not understand our nebbishy ways). We were primarily wondering if I-bonds were suddenly a playa given the recent high CPI-U and the extra bonus of not being taxed by the state on interest. Or was a state municipal bond fund better? Or a taxable socially responsible bond fund?

I was obsessed with doing the math but it was a struggle since I'm still learning. If I've made some mistakes, please let me know!

Tax Equivalent Yield Formula

Operation Parameters

Federal tax is deferred on an I-Bond, but it is exempt from MA tax. Since we can't predict the future fixed rates or the CPI-U, I assumed a buy in late October and selling in 14 months. This would count as 15 months and the 3 months of as yet unknown interest would be forfeit. Jonathan has already done all the hard work to figure out the blended rate in this case as 5.02%. Since only state tax can be factored in here, the taxable equivalent yield is 5.29%. The yield is paid out as interest (cash).

Option 2: MA Sales Tax Bond (5.52%)

Digging around the Fidelity site, I found a single municipal bond with a relatively high yield to compare. The current price is $108.511 per $100 so $20,000 would buy 184 bonds ( I think I have that right). The coupon pays 5% so the yield is currently calculated at 3.85%. Because this bond is federal and state tax free, the taxable equivalent yield is just over 5.52%

Option 3: FDMMX (approx 5.82%)

The Fidelity Massachusetts Municipal Income Fund is federal and state tax free. This fund requires an initial investment of $10,000. The current price per share is $12.03 so $20k would by roughly 1662 shares. The dividend is currently $0.04 per share. Given that dividends are re-invested (They *are* reinvested, right? if so, approx 5-6 shares a month added), I ended up estimating a yield of 4.06 which is a taxable equivalent yield of 5.82%

So if my calculations are right I-Bonds don't look that sexy compared to the munis (I-Bonds are sexy for other reasons though including low barrier to entry for such a nice rate) and a taxable bond fund would have to yield at least 5.52% after all expenses and loads were accounted for in order to really compete with municipal bonds...

Or am I all wrong?

[Update: Of course, Dinkytown has a helpful calculator for figuring out TEY on a Municipal Bond]

I was obsessed with doing the math but it was a struggle since I'm still learning. If I've made some mistakes, please let me know!

Tax Equivalent Yield Formula

tax equivalent yield = yield / ( 1 - applicable tax rates)

Operation Parameters

- Federal Marginal Tax Rate: 25%

- MA State Tax Rate: 5.3%

- Amount invested: $20,000

Federal tax is deferred on an I-Bond, but it is exempt from MA tax. Since we can't predict the future fixed rates or the CPI-U, I assumed a buy in late October and selling in 14 months. This would count as 15 months and the 3 months of as yet unknown interest would be forfeit. Jonathan has already done all the hard work to figure out the blended rate in this case as 5.02%. Since only state tax can be factored in here, the taxable equivalent yield is 5.29%. The yield is paid out as interest (cash).

Option 2: MA Sales Tax Bond (5.52%)

Digging around the Fidelity site, I found a single municipal bond with a relatively high yield to compare. The current price is $108.511 per $100 so $20,000 would buy 184 bonds ( I think I have that right). The coupon pays 5% so the yield is currently calculated at 3.85%. Because this bond is federal and state tax free, the taxable equivalent yield is just over 5.52%

Option 3: FDMMX (approx 5.82%)

The Fidelity Massachusetts Municipal Income Fund is federal and state tax free. This fund requires an initial investment of $10,000. The current price per share is $12.03 so $20k would by roughly 1662 shares. The dividend is currently $0.04 per share. Given that dividends are re-invested (They *are* reinvested, right? if so, approx 5-6 shares a month added), I ended up estimating a yield of 4.06 which is a taxable equivalent yield of 5.82%

So if my calculations are right I-Bonds don't look that sexy compared to the munis (I-Bonds are sexy for other reasons though including low barrier to entry for such a nice rate) and a taxable bond fund would have to yield at least 5.52% after all expenses and loads were accounted for in order to really compete with municipal bonds...

Or am I all wrong?

[Update: Of course, Dinkytown has a helpful calculator for figuring out TEY on a Municipal Bond]

Friday, October 21, 2005

Missing Money: Found

The abandoned bank balance that I found and claimed a couple of months ago finally arrived today. I had quite the time of it getting the right paperwork (I no longer had a statement etc) but once I mailed it in, it didn't really take that long to arrive.

The check is actually for $43.10 so I've earned a very small amount of interest in these 10 years, but hey...it was nice that it was more than what I thought. Right now it's helping me with cash flow until my large expense reimbursement shows up next month (yes, the forty bucks is really needed...I saved aggressively this month and the "cupboard" is bare until I'm reimbursed). At the end of the month, it goes in ING (short term savings)

My thanks to Karen at My Financial Progress Report for having the link to Missing Money in her sidebar!

The check is actually for $43.10 so I've earned a very small amount of interest in these 10 years, but hey...it was nice that it was more than what I thought. Right now it's helping me with cash flow until my large expense reimbursement shows up next month (yes, the forty bucks is really needed...I saved aggressively this month and the "cupboard" is bare until I'm reimbursed). At the end of the month, it goes in ING (short term savings)

My thanks to Karen at My Financial Progress Report for having the link to Missing Money in her sidebar!

Thursday, October 20, 2005

HSBC OnlineSavings

I am in an account opening frenzy...I just applied for my HSBC OnlineSavings account which carries a $35 sign-up bonus for the rest of the month. I wasn't going to do it because I am sort of swimming in accounts right now, but HSBC is also my mortgage holder and I am trying to investigate paying my mortgage twice a month (without ridiculous fees that is) and they somehow tie online mortgage management to having an account. So, I thought I'd see if their savings account would...er..."count" and nab $35 in the deal.

Playing with I-Bonds

Like Michael, I couldn't resist the lure of the I-Bonds particularly because Jonathan's been posting exciting I-Bonds tidbits for days. I've opened a TreasuryDirect account and I will most likely dip my toe in tomorrow.

I do not yet have sizeable cash for investing, so I am thinking of doing a couple small purchases now and late November...probably equivalent to my birthday money. This is really more about having fun than making gobs of interest at this point. I guess I want to play like the cool kids do ;)

There is something about ACH transfers that just makes me feel so...in control. Is that weird?

I do not yet have sizeable cash for investing, so I am thinking of doing a couple small purchases now and late November...probably equivalent to my birthday money. This is really more about having fun than making gobs of interest at this point. I guess I want to play like the cool kids do ;)

There is something about ACH transfers that just makes me feel so...in control. Is that weird?

Tuesday, October 18, 2005

Carnival Catch Up

This week is already a doozy due to some work demands. I am very happy to be able to be working from home this week, but even so I am already falling behind. I've barely *glanced* at the new Carnival of Personal Finance #18 (skillfully hosted by Jonathan at MyMoneyBlog) let alone posted about it.

There's a ton of stuff this week particularly regarding investing and frugal living...gotta get reading!

There's a ton of stuff this week particularly regarding investing and frugal living...gotta get reading!

Future Spending Money

Noah at Okdork.com recently asked me

When I look at where my most successful savings are to date it's in my retirement funds. I got on the 401k bandwagon ASAP and shortly thereafter made a decision to always contribute the maximum. I think this was the perfect storm of: set a goal, pay yourself first, and automate.

By setting the goal of "always maximize the 401(k) contribution" I at least had something to shoot for. I have been horrible at setting goals and it's definitely hurt my progress. But something about the 401(k) decision just stuck. And I felt unwavering in my dedication to it.

I paid myself first by taking that money off the top and considering what was left to be what had to cover expenses. Some call this the "two line budget" ;)

And this was all automated via my paycheck deductions so I never had to think twice about it...the money went right into the 401(k) and I never "saw" it in my checking account and obviously the allocations are set up automatically so...no muss no fuss.

Now that I am engaged in the care and feeding of an actual, non-retirement, savings account I think I can put this insight to good use. I have set some goals...but...they could be better (not surprisingly I am doing fine with my goal to maximize my Roth contribution!) so I really need to address that. I am currently paying myself last(!) Other than a small token automatic deposit (I *am* automating!) I am mostly seeing what is left at the end of the month for savings. That is fine to do as long as it is accompanied by a set amount that is helping to meet a goal.

Truly "paying yourself first" requires a total shift for some of us. For me, I must decide how much I want to save...FIRST instead of just saving what's left at the end of trying to be frugal. And this requires conquering the idea that "savings is a subtraction" (I've done that for retirement...so maybe that's the fourth ingredient in my perfect storm?)

MP Dunleavey makes a great point about this attitude in her article "Why So Many Women Can't Save":

"[What's] the largest factor in saving the most money for you?"and I thought that was a great question ... because I really had to think about the answer. Now, I am no saving genius, but I think that by understanding the answer I can improve.

When I look at where my most successful savings are to date it's in my retirement funds. I got on the 401k bandwagon ASAP and shortly thereafter made a decision to always contribute the maximum. I think this was the perfect storm of: set a goal, pay yourself first, and automate.

By setting the goal of "always maximize the 401(k) contribution" I at least had something to shoot for. I have been horrible at setting goals and it's definitely hurt my progress. But something about the 401(k) decision just stuck. And I felt unwavering in my dedication to it.

I paid myself first by taking that money off the top and considering what was left to be what had to cover expenses. Some call this the "two line budget" ;)

And this was all automated via my paycheck deductions so I never had to think twice about it...the money went right into the 401(k) and I never "saw" it in my checking account and obviously the allocations are set up automatically so...no muss no fuss.

Now that I am engaged in the care and feeding of an actual, non-retirement, savings account I think I can put this insight to good use. I have set some goals...but...they could be better (not surprisingly I am doing fine with my goal to maximize my Roth contribution!) so I really need to address that. I am currently paying myself last(!) Other than a small token automatic deposit (I *am* automating!) I am mostly seeing what is left at the end of the month for savings. That is fine to do as long as it is accompanied by a set amount that is helping to meet a goal.

Truly "paying yourself first" requires a total shift for some of us. For me, I must decide how much I want to save...FIRST instead of just saving what's left at the end of trying to be frugal. And this requires conquering the idea that "savings is a subtraction" (I've done that for retirement...so maybe that's the fourth ingredient in my perfect storm?)

MP Dunleavey makes a great point about this attitude in her article "Why So Many Women Can't Save":

The misconception that underscores all three of these anti-saving attitudes is the notion that savings is a subtraction.

Women, especially I think, tend to equate savings with being on a diet: I have to cut back, deprive myself, do without.

In fact, what research by the Consumer Federation of America showed is that you need savings not only for peace of mind but to spend on all the various things that crop up.

So rather than think of it as savings, think of it as future spending money.

Monday, October 17, 2005

Roth-O-Meter Update: 36%

The Roth-O-Meter is up to 36% ( technically 35.75% but I like whole numbers) as of today's $520 contribution to my Fidelity Roth IRA. My intent is to make 5 more $520 contributions in the second half of each month until March. This will get me to my goal of maxing out my 2005 contribution.

As of April 2006, I will drop the amount to about $444 (the "remaining" $76 will be destined for non-retirement savings at that point) for the 2006 contribution year and hit the max contribution by December 2006.

That's the plan Stan.

As of April 2006, I will drop the amount to about $444 (the "remaining" $76 will be destined for non-retirement savings at that point) for the 2006 contribution year and hit the max contribution by December 2006.

That's the plan Stan.

Sunday, October 16, 2005

Don't Blow the Rebate

pfadvice makes a very good point on my Tivo post to make sure to follow through on the rebate. Fortunately, we have an established process that ensures we take care of our rebates. Our Tivo rebate is all filled out and in it's stamped envelope awaiting the mail carrier. We've also retrieved $57.44 in rebates so far this year that have been added to our ING Direct savings account.

But it wasn't always this way. Here's what we did to wrangle our rebates:

But it wasn't always this way. Here's what we did to wrangle our rebates:

- Pick a "Rebate Boss" Designate a single person in your household to do the rebates. Choose the person who is most likely to succeed of course ;) In our house, that's LaLa. She fills out the forms, makes the requisite copies, sends the rebates, and keeps a tickler file. It just helps us to have the responsibility lie with one of us specifically.

- Just Do It Don't put off filling out the forms or making copies, do it immediately. If there is something you need that will take more time, get everything else ready to go. I used to procrastinate and then the rebate would get lost in the clutter and poof. LaLa gets everything together as soon as possible: makes the copies, gathers all the pieces, including the envelope while she's motivated by the idea of the rebate money.

- Keep Track and Follow Up Once our rebates are sent out, we put them in a folder and wait for the money. Every month or so we check the folder (and/or online if possible). We've never had to follow up on a rebate that didn't show up, but the Travel Gnome has (successfully so).

Friday, October 14, 2005

2005 Spending Plan

I firmly believe that an annual spending plan makes a good companion to any budget.

By creating a list of things you know you'll need soon and having an idea of how much money you will need to save before purchasing them it's easier to avoid debt. Not only will you have the cash on hand, but it's easier to prioritize your "big ticket" spending and not go overboard.

Earlier in the year I created a 2005 spending plan on Tadalist (I have since moved it to Backpack so I can include more budget detail easily). I knew we'd be taking certain vacations, doing some home maintenance, and we desperately needed a new washer. Over time I fill in cost estimates as I do research and things become more clear.

This gives me a very high-level sense of an expense "category" that used to be hidden from my view until the credit card statement showed up. As things get closer in time, the detail gets filled in, and I can make sure I have the money ready or I wait until I do.

I spent some time on my plan tonight in preparation for a spendie fourth quarter. We have at least two trips coming up (possibly a third) and of course Christmas. I also moved items that we just couldn't afford this year into a new 2006 spending plan that is basically in skeleton form. I need to really start nailing down some budgets for our trips since I've let it go too long.

[UPDATE: I corrected the link to the spending plan, I had used the admin version of the link and not the public one. oops]

By creating a list of things you know you'll need soon and having an idea of how much money you will need to save before purchasing them it's easier to avoid debt. Not only will you have the cash on hand, but it's easier to prioritize your "big ticket" spending and not go overboard.

Earlier in the year I created a 2005 spending plan on Tadalist (I have since moved it to Backpack so I can include more budget detail easily). I knew we'd be taking certain vacations, doing some home maintenance, and we desperately needed a new washer. Over time I fill in cost estimates as I do research and things become more clear.

This gives me a very high-level sense of an expense "category" that used to be hidden from my view until the credit card statement showed up. As things get closer in time, the detail gets filled in, and I can make sure I have the money ready or I wait until I do.

I spent some time on my plan tonight in preparation for a spendie fourth quarter. We have at least two trips coming up (possibly a third) and of course Christmas. I also moved items that we just couldn't afford this year into a new 2006 spending plan that is basically in skeleton form. I need to really start nailing down some budgets for our trips since I've let it go too long.

[UPDATE: I corrected the link to the spending plan, I had used the admin version of the link and not the public one. oops]

40hr Tivo Series 2...for $9

We've been fanatic Tivo users for over 5 years now and our Series 1 (the original Tivo) has served us well. Two years ago I bought a third-party hard drive from Weaknees to drastically increase my storage capacity quite inexpensively as an alternative to buying a new Series 2 model.

In 2000 we chose the $9.99 monthly service over the $250 product lifetime version because Tivos were so new at the time we didnt know what the story would be in 2 years then the lifetime would have paid for itself. Well the monthly charge is $11.95 and lifetime memberships are now $299 but Tivo is such an integral part of our home entertainment, I classify the service as "Utility" (laugh all you want)

I have lusted in my heart for a Series 2 Tivo since they were announced. And we have become so frustrated without "folders" to organize our many shows on disk that a new Tivo was added to our 2005 spending plan at an expected cost of $200.

Tivo has been selling their 40 hour ($199.99) model for $49.99 after $150 mail-in rebate for a while now and we were planning to make our move during the holidays. But...

Last night I got an email announcing a Tivo and BestBuy promotion that will ALSO credit me 3 months of Tivo service (a $38.85 value) while supplies (of the rebate card) last. Needless to say, LaLa just returned from BestBuy a bit ago and the rebate paperwork is all ready to be mailed.

The cost breaks down like so:

I guess I'm pretty happy that something that we both really wanted only ended up costing us less than 5% of what we had budgeted. I'm not saying everyone should run out and buy one because of this (because there is that pesky service fee - monthly or lifetime) but if you are so inclined I can't recommend it enough. And if by chance, you want to throw me a bone, you could put my email address in the "referrer" field when you activate and make me happy!

...they know me as tinymachine at gmail dot c o m

And I do realize this is probably a blow out price because they are about to announce something new, but this will keep me happy for a while.

In 2000 we chose the $9.99 monthly service over the $250 product lifetime version because Tivos were so new at the time we didnt know what the story would be in 2 years then the lifetime would have paid for itself. Well the monthly charge is $11.95 and lifetime memberships are now $299 but Tivo is such an integral part of our home entertainment, I classify the service as "Utility" (laugh all you want)

I have lusted in my heart for a Series 2 Tivo since they were announced. And we have become so frustrated without "folders" to organize our many shows on disk that a new Tivo was added to our 2005 spending plan at an expected cost of $200.

Tivo has been selling their 40 hour ($199.99) model for $49.99 after $150 mail-in rebate for a while now and we were planning to make our move during the holidays. But...

Last night I got an email announcing a Tivo and BestBuy promotion that will ALSO credit me 3 months of Tivo service (a $38.85 value) while supplies (of the rebate card) last. Needless to say, LaLa just returned from BestBuy a bit ago and the rebate paperwork is all ready to be mailed.

The cost breaks down like so:

$199.99 Cost of 40 hr Tivo Series 2

1.99 Expected 1% rebate via Citi Dividend

150.00 Mail-in rebate

38.85 3-month Tivo service credit

===================================================

$9.15 Net cost of new Tivo

I guess I'm pretty happy that something that we both really wanted only ended up costing us less than 5% of what we had budgeted. I'm not saying everyone should run out and buy one because of this (because there is that pesky service fee - monthly or lifetime) but if you are so inclined I can't recommend it enough. And if by chance, you want to throw me a bone, you could put my email address in the "referrer" field when you activate and make me happy!

...they know me as tinymachine at gmail dot c o m

And I do realize this is probably a blow out price because they are about to announce something new, but this will keep me happy for a while.

Wednesday, October 12, 2005

14 Months History Now in NetworthIQ

A few months ago I started tracking my monthly networth using NetworkIQ. I had put in a rough approximation of my networth as of 12/2004 and then the last three months or so were pretty accurate according to Quicken (well, my version of my Quicken records..we disagree slightly).

I just spent some time backfilling my history back to August of last year. I know this is beta software, and I do think they have a nifty idea, but their interface blows for filling in historical data. I won't pick on them here, because I bet they are pretty neato folks.

Because I just can't bear to add the badge to my template for reasons of style (let's face it...those greens do not match, Honey!) and some illusion of discretion, you can see the results here.

I just spent some time backfilling my history back to August of last year. I know this is beta software, and I do think they have a nifty idea, but their interface blows for filling in historical data. I won't pick on them here, because I bet they are pretty neato folks.

Because I just can't bear to add the badge to my template for reasons of style (let's face it...those greens do not match, Honey!) and some illusion of discretion, you can see the results here.

Monday, October 10, 2005

October Pantry Challenge!

No, not panty challenge you dweeb! pantry ... as in where I story my dry goods. And by dry goods, I mean "all sorts of weird things I've picked up over time and never turned into a yummy meal"

If you think I am delinquent about watching DVDs, you really should look at the food I am storing. Between my pantry (and by pantry I mean "loose conglomeration of unorganized cabinets and basement shelfspace") and my freezer (and by freezer I mean "my freezer") I have all sorts of both mundane and exotic tasties.

By eating our way through our cupboards this month, I hope to save money on groceries and clear out some of the pantry and freezer clutter. I enjoy a creative challenge too...so this should help us figure out what to have for dinner this month and keep our shopping targeted to things we need each week and a few ingredients we may need to complete dishes.

Excuse me while I go look up some recipes for lentils...

If you think I am delinquent about watching DVDs, you really should look at the food I am storing. Between my pantry (and by pantry I mean "loose conglomeration of unorganized cabinets and basement shelfspace") and my freezer (and by freezer I mean "my freezer") I have all sorts of both mundane and exotic tasties.

By eating our way through our cupboards this month, I hope to save money on groceries and clear out some of the pantry and freezer clutter. I enjoy a creative challenge too...so this should help us figure out what to have for dinner this month and keep our shopping targeted to things we need each week and a few ingredients we may need to complete dishes.

Excuse me while I go look up some recipes for lentils...

Sunday, October 09, 2005

Netflix Cost Analysis

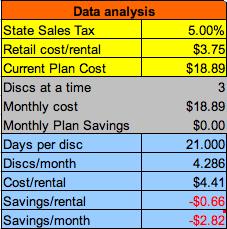

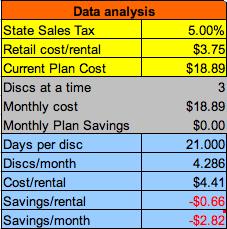

Lately I have been intrigued by the lower tier of accounts offered by Netflix as a potential way to cut my costs with minimal impact. I had intended to make a spreadsheet to figure out exactly how many DVDs I had rented over the last four years and what my average cost per disc was, with an ultimate goal of evaluating the cheaper account types.

Then just last week while perusing Lifehacker, I found a link to a Netflix analysis spreadsheet created by Geektronica. My Netflix rental history wasn't importing as expected so I modified the workbook to contain the history on one sheet and the analysis on another. I changed the formulas accordingly and modified the analysis page to compare potential savings with other account types.

After requesting my entire rental history, I plugged in all four years and faced the fact that Netflix has been about convenience for me and not about saving money.

I used a retail rental cost of $3.75 because apparently that's what the place up the street charges (according to Pepper). MA sales tax is only 5% so that doesn't bloat the Netflix fee too much. My "days per disc" and "cost per rental" are so high because there have been a few occasions where we kept a movie for an insanely long time. Why? Because we're *lame*.

Two movies were kept for over 230 days. And one we never did watch...we just sent back. Four more movies were kept for about 3-4 months each. And twenty-three movies were kept between 1 and 2 months. These thirty discs, and our inability to just watch them or send them back have totally skewed the money saving potential of Netflix for me. Ouch.

The new plan is this:

Then just last week while perusing Lifehacker, I found a link to a Netflix analysis spreadsheet created by Geektronica. My Netflix rental history wasn't importing as expected so I modified the workbook to contain the history on one sheet and the analysis on another. I changed the formulas accordingly and modified the analysis page to compare potential savings with other account types.

After requesting my entire rental history, I plugged in all four years and faced the fact that Netflix has been about convenience for me and not about saving money.

I used a retail rental cost of $3.75 because apparently that's what the place up the street charges (according to Pepper). MA sales tax is only 5% so that doesn't bloat the Netflix fee too much. My "days per disc" and "cost per rental" are so high because there have been a few occasions where we kept a movie for an insanely long time. Why? Because we're *lame*.

Two movies were kept for over 230 days. And one we never did watch...we just sent back. Four more movies were kept for about 3-4 months each. And twenty-three movies were kept between 1 and 2 months. These thirty discs, and our inability to just watch them or send them back have totally skewed the money saving potential of Netflix for me. Ouch.

The new plan is this:

- If a disc sits for 30 days without being watched, it goes back unwatched

- Decide on a cheaper netflix plan that still allows unlimited rentals

Related Links:

Listology's Netflix Tracker

Manuel's Price-Per-Rental Calculator

HackingNetflix

Saturday, October 08, 2005

Roth-O-Meter

I've added a Roth-O-Meter to reflect my more recent goal of maximizing my 2005 Roth IRA contribution. As of today I am about 23% of the way there and intend on a monthly increase of 13% through March. In April I will begin my 2006 Roth IRA contributions.

The Roth is where I have been concentrating my savings since both my 2004 Roth was "paid off" and my paycut has taken effect. And my decision to focus on my Roth has drastically reduced the amount that goes toward non-retirement savings...prompting a re-evaluation of my goals. Stay tuned.

The Roth is where I have been concentrating my savings since both my 2004 Roth was "paid off" and my paycut has taken effect. And my decision to focus on my Roth has drastically reduced the amount that goes toward non-retirement savings...prompting a re-evaluation of my goals. Stay tuned.

22% Lower Cable/Phone/Internet

LaLa finally made the call last week to cancel our Digital Vision service from the cable portion of our telecomm service. This will save us about $12 a month going forward. This is on top of the $20 off each month for 12 months we got just for asking threatening to switch to a competitor.

This brings our total current savings to $32 a month - a 22% decline in our telecomm charges.

We considered cutting other itemized charges once we were staring closely at the bill. I'm just not ready to give up the $3.50 a month for distinctive ring (our fax line...but I may cave next month). Since my company reimburses the cable modem rental, I am also forgoing the option to buy my own (which would come out of my own pocket) until I am no longer reimbursed for my broadband access.

I also just cannot bear to live without Caller ID. This might seem dumb, since I could probably let my answering machine do my "screening", but I do find this useful for work when I am working from home. I think $7 a month is overpriced for what it costs the providers (like...nothing, right?) but I'd rather just not have a phone than give it up. Sorry SavvySaver! (I promise I gave it thought)

Another tip for those looking to save money on phone service: long ago I stopped paying for voicemail service when it dawned on me that it was equivalent to renting an answering machine. For a long while we used a very simple, older machine but when we needed a new phone a few years ago we bought a two handset model with a digital answering machine built in. Since we purchased it at Costco it was very economical.

This brings our total current savings to $32 a month - a 22% decline in our telecomm charges.

We considered cutting other itemized charges once we were staring closely at the bill. I'm just not ready to give up the $3.50 a month for distinctive ring (our fax line...but I may cave next month). Since my company reimburses the cable modem rental, I am also forgoing the option to buy my own (which would come out of my own pocket) until I am no longer reimbursed for my broadband access.

I also just cannot bear to live without Caller ID. This might seem dumb, since I could probably let my answering machine do my "screening", but I do find this useful for work when I am working from home. I think $7 a month is overpriced for what it costs the providers (like...nothing, right?) but I'd rather just not have a phone than give it up. Sorry SavvySaver! (I promise I gave it thought)

Another tip for those looking to save money on phone service: long ago I stopped paying for voicemail service when it dawned on me that it was equivalent to renting an answering machine. For a long while we used a very simple, older machine but when we needed a new phone a few years ago we bought a two handset model with a digital answering machine built in. Since we purchased it at Costco it was very economical.

Sunday, October 02, 2005

Thrift Store Treasure

LaLa loves going to the thrift store...it's her hobby. She usually stops in on her way home from the gym, so three times a week she engages in meditative combing through the racks in search of treasure.

Some days she buys nothing and some overzealous days she brings home something we ultimately decide to return. But most time she is able to find very good value that truly augments our regular retail purchases.

Like a royal blue $21 Paul Frank Julius Tee for only 99c or the time she bought a small shoulder bag to replace her bulky gym bag and found money in the outer pocket.

Well LaLa found a North Face winter shell for $8 last week. The new version of this North Face jacket retails around $300. While some of that price is just because of the North Face name, they got their rep building high quality gear, so the rest of the price is for a fully featured jacket. LaLa needed something both wind and waterproof mainly for winter shoveling and she ended up with something very versatile that is high quality and durable.

Our friend "GearGirl", who works at Eastern Mountain Sports part-time brought over her Gore-Tex cleaner (Nikwax Tech Wash), gave us care instructions and walked us through all the jacket's features (pit zips! who knew?)

In order to clean and "revive" the jacket, we will use the tech wash (*not* regular detergent) and then either dry it for about 20 minutes in the dryer or air dry and pop it in the dryer for only a few minutes to heat activate the water repellant coating. And then it should be as good as new! But for less than 3% of the price ;)

Some days she buys nothing and some overzealous days she brings home something we ultimately decide to return. But most time she is able to find very good value that truly augments our regular retail purchases.

Like a royal blue $21 Paul Frank Julius Tee for only 99c or the time she bought a small shoulder bag to replace her bulky gym bag and found money in the outer pocket.

Well LaLa found a North Face winter shell for $8 last week. The new version of this North Face jacket retails around $300. While some of that price is just because of the North Face name, they got their rep building high quality gear, so the rest of the price is for a fully featured jacket. LaLa needed something both wind and waterproof mainly for winter shoveling and she ended up with something very versatile that is high quality and durable.

Our friend "GearGirl", who works at Eastern Mountain Sports part-time brought over her Gore-Tex cleaner (Nikwax Tech Wash), gave us care instructions and walked us through all the jacket's features (pit zips! who knew?)

In order to clean and "revive" the jacket, we will use the tech wash (*not* regular detergent) and then either dry it for about 20 minutes in the dryer or air dry and pop it in the dryer for only a few minutes to heat activate the water repellant coating. And then it should be as good as new! But for less than 3% of the price ;)

Birthday Cash Transferred to Roth

Yesterday I initiated an electronic transfer of the money I received for my birthday into my Fidelity Roth IRA. I had moved it into ING while deciding what to do with it and my ING account has become like a psychological lockbox for me. Once money goes in there, I will do anything to keep from taking it out (including not taking it out even when I intend to!). This is a good thing to know about myself and I can use it to my advantage...as long as I don't turn into a modern equivalent of a mattress stuffing nut.

All that is to say that I challenged myself to BOTH leave the money in ING and make a matching contribution to my Roth...and I did that. So I successfully "matched" my birthday cash savings.

I now have contributed $880 to my 2005 Roth and intend to meet the maximum before the deadline in April 2006. Starting in October, I switch over to making monthly $520 contributions which should get interesting.

All that is to say that I challenged myself to BOTH leave the money in ING and make a matching contribution to my Roth...and I did that. So I successfully "matched" my birthday cash savings.

I now have contributed $880 to my 2005 Roth and intend to meet the maximum before the deadline in April 2006. Starting in October, I switch over to making monthly $520 contributions which should get interesting.

Saturday, October 01, 2005

$25 from USAA...finally

In the process of doing month end finances, I noticed that USAA did indeed credit my checking account for using their free online bill payment service. I paid a single bill in early August and at the beginning of last week the $25 promotional credit was posted.

It took them a while, and I honestly thought I would never see that money, but I'm happy now. I wonder if this counts as interest income at tax time...

It took them a while, and I honestly thought I would never see that money, but I'm happy now. I wonder if this counts as interest income at tax time...

Subscribe to:

Comments (Atom)